Flexible Business Capital Whenever You Need It!

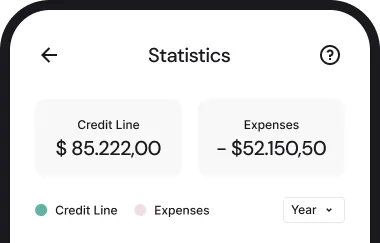

Access a revolving line of credit to cover expenses, invest in growth, and manage cash flow on your terms.

Why Choose a Business Line of Credit?

A business line of credit gives you on-demand access to capital, ensuring you always have the funds to seize opportunities or tackle unexpected expenses. Unlike traditional loans, a line of credit allows you to withdraw only what you need and only pay interest on the amount you use.

Flexible Funding: Access capital whenever you need it, without reapplying.

Pay Interest Only on What You Use: No need to borrow more than necessary.

Quick Access to Capital: Get approved and withdraw funds within days.

Reusable Credit: Once you repay, your available balance resets.

Boosts Cash Flow Stability: Handle seasonal fluctuations and unexpected expenses.

How To Get Business Funding In 3 Easy Steps

Apply Online

Provide your basic information and get approved within the next

24-48 hours

Review Approved Terms

Review your approved options. After funding options are selected, funds are deposited into your business checking account.

Make Payments

After payments are made on time, you can renew or refinance your business line for more money and lower rates.

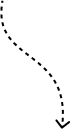

Trusted by 1,000+ clients

Frequently Asked Questions

What differentiates FundLocker from other financial management firms?

Our customized approach and expert team with diverse sector backgrounds set us apart.

Can FundLocker help my startup secure funding?

Absolutely We specialize in helping startups identify suitable funding options and assist in negotiations.

How does FundLocker ensure confidentiality and security of financial information?

Client confidentiality and data security are paramount at FundLocker. We employ stringent compliance measures, including data encryption and secure channels for communication, ensuring that all client information remains confidential and protected.

Does FundLocker provide services internationally?

Yes, we serve clients globally, offering tailored financial consulting and management services.

What is the typical duration of a consulting engagement with FundLocker?

The duration varies based on client needs, ranging from a few weeks to several months.

How can I start working with FundLocker?

Contact us through our website or phone to set up an initial consultation.

Want to work with us?

Earn high commissions by simply connecting us to small business owners that want capital!

COMPANY

FUNDING OPTIONS

LEGAL

FOLLOW US

Copyright 2026. Fundlocker LLC. All Rights Reserved.